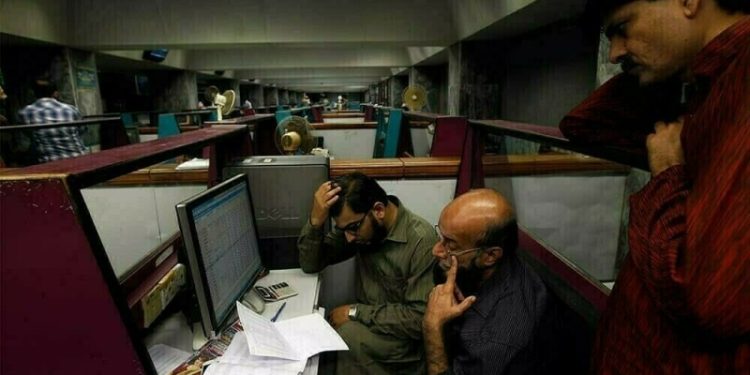

A volatile session was experienced at the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index losing nearly 1,200 points during intra-day trading on Monday.

The market kicked off trading on a positive with the benchmark index hitting an intra-day high of 118,765 points.

However, selling pressure soon emerged dragging the index to an intra-day low of 115,941.

By 2:50pm, the benchmark index was hovering at 116,391.21, a decrease of 1,195.77 points or 1.02%.

Selling pressure was observed in key sectors including commercial banks, oil and gas exploration companies, OMCs and power generation. Index-heavy stocks including HUBCO, PSO, SHELL, SSGC, MARI, OGDC, PPL, HBL, MCB, MEBL and NBP traded in the red.

“We think it is a good time to accumulate cement on dips, as the sector can outperform defensive sectors over the next six months if the hitherto pricing discipline sustains, in our view,” said Intermarket Securities.

During the previous week, PSX witnessed a bullish trend and hit new highest-ever levels with healthy gains during the outgoing week ended on January 03, 2025, on the back of investor strong interest coupled with institutional support.

The benchmark KSE-100 index surged by 6,235.80 points on a week-on-week basis and closed at its new highest-ever level of 117,586.98 points.

Internationally, share markets got off to a patchy start in Asia on Monday ahead of a week brimming with economic news that should underline the relative outperformance of the United States and support the dollar’s ongoing bull run.

Political uncertainty remained a feature as the Globe and Mail reported embattled Canadian Prime Minister Justin Trudeau would announce his resignation as early as Monday.

The star of the US data line up is the December payrolls report on Friday, where analysts expect a rise of 150,000 with unemployment holding at 4.2%.

These will be reviewed by data on ADP hiring, job openings and weekly jobless claims, along with surveys on manufacturing, services and consumer sentiment.

Anything upbeat would support the case for fewer rate cuts from the Federal Reserve, and markets have already scaled back expectations to just 40 basis points for 2025.

Minutes of the Fed’s last meeting due Wednesday will offer colour on their dot plot predictions, while there will be plenty of live comment with at least seven top policymakers speaking including influential Fed Governor Christopher Waller.

MSCI’s broadest index of Asia-Pacific shares outside Japan, tab gained 0.6%, having lost 1% last week.

This is an intra-day update