Wall Street’s main indexes declined on Friday as investors continued to navigate the complex landscape of tariffs, with FedEx becoming the latest firm to adjust its annual projections due to economic uncertainties.

FedEx fell 10.9%, while peer UPS lost 3.3%. Delivery firms are often seen as a barometer for the global economy given their involvement in a wide range of industries.

The delivery companies weighed on the Dow Jones Transport Index, which is often seen as a gauge of U.S. economic health. The index fell 2.1% and has lost over 19% from its November all-time peak.

Airlines such as Delta and United also dragged the index lower, after Britain’s Heathrow Airport was shut, sparking global travel turmoil.

In an interview, Chicago Federal Reserve President Austan Goolsbee noted that the current conditions could “maybe” a shock to the economy.

Separately, New York Fed President John Williams reiterated the U.S. central bank’s monetary policy stance, given the uncertainty.

Lingering fears of a prolonged global trade war, threatening to unravel economic stability and squeeze corporate profits, have cast a shadow over markets.

Markets now await President Donald Trump’s plans on reciprocal and sectoral tariffs that are expected to take effect in early April.

Wall St rises in choppy trading, Fed comments provide tailwind

“We really don’t know what the wild card is coming out of Washington, and this goes for the Fed as well,” said Michael Matousek, head trader at U.S. Global Investors Inc.

At 9:54 a.m. ET, the Dow Jones Industrial Average fell 438.68 points, or 1.05%, to 41,514.64, the S&P 500 lost 49.00 points, or 0.87%, to 5,613.89 and the Nasdaq Composite lost 140.39 points, or 0.79%, to 17,551.24.

Materials led declines among the 11 S&P 500 sectors with a 1.7% drop.

Friday’s session also marks the simultaneous expiry of quarterly derivatives contracts tied to stocks, index options and futures, also known as “triple witching”, which added to market volatility.

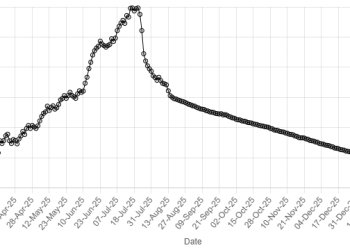

On a weekly scale, the benchmark S&P 500 index is on track to mark its fifth-straight week in the red – its longest weekly losing streak since May 2022.

The tech-heavy Nasdaq is on track to record its longest weekly losing streak in nearly three years, while the blue-chip Dow is positioned for marginal gains.

Earlier in the week, investors took some comfort from comments of Fed Chair Jerome Powell, who said that the overall economy was on solid footing, but warned of a cloudy outlook on the impact from Trump’s policies.

Traders are pricing in approximately 70 basis points of rate cuts from the Fed this year, according to data compiled by LSEG. Nike slid 8.4% after the sports apparel maker projected a sharper decline in fourth-quarter revenue than analysts had anticipated.

Micron Technology fell 7.3% as the chip maker forecast third-quarter gross margin below estimates.

Lennar slid 6.6% after the homebuilder reported a lower first-quarter profit.

Declining issues outnumbered advancers by a 4.22-to-1 ratio on the NYSE and by a 3.1-to-1 ratio on the Nasdaq.

The S&P 500 posted nine new 52-week highs and 16 new lows, while the Nasdaq Composite recorded 14 new highs and 116 new lows.

American Dollar Exchange Rate

American Dollar Exchange Rate