Wall Street’s main indexes were poised for a muted open on Friday as investors awaited a long-delayed inflation report that could shape the Federal Reserve’s policy path.

Focus is on the Commerce Department’s Personal Consumption Expenditures Price Index, the Fed’s preferred inflation gauge and the first such release since a 43-day government shutdown froze official statistics. The report is due at 10 a.m. ET.

Traders have been pricing in an 87% chance that the Federal Reserve will lower borrowing costs by 25 basis points when it meets this month, according to CME’s FedWatch Tool.

Investors also expect the Fed to deliver another quarter-point rate cut by June 2026.

Economists polled by Reuters see PCE running at a 2.8% year-on-year pace, a notch above August’s 2.7%, with month-on-month gains holding steady at 0.3%.

In dealmaking news, shares of Warner Bros. Discovery were up 4.3% in premarket trading after Netflix agreed to buy one of Hollywood’s most prized, decades-old assets for $72 billion, ending a weeks-long bidding war.

Shares of the streaming giant were down 4.2%.

“It’s super interesting that the bidding came down to Netflix winning and that a lot is being focused on the streaming business, which you know is Netflix’s business,” said Kim Forrest, chief investment officer at Bokeh Capital Partners.

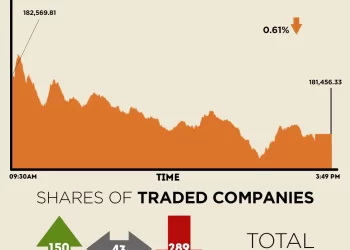

At 08:36 a.m. ET, Dow E-minis were down 14 points, or 0.03%, S&P 500 E-minis were up 4 points, or 0.06%, Nasdaq 100 E-minis were up 30 points, or 0.12%.

The PCE report lands just days before what is shaping up to be one of the Fed’s most contentious meetings in years, as policymakers debate whether to cut borrowing costs whileweighing evidence of sticky inflation against the mandate of maximum employment.

Secondary labor indicators so far show little sign of an imminent slowdown in hiring, giving inflation hawks fresh ammunition as the central bank looks for clearer progress toward its 2% target.

“In purely numerical terms, the camp in favor of unchanged interest rates is currently slightly ahead. However, the governors seem to be leaning more toward an interest rate cut,” said Commerzbank’s chief economist, Jörg Krämer.

“The decisive factor is likely to be which way Fed Chair Powell leans and how successful he is in persuading other members to follow him.”

Still, dovish remarks from several influential policymakers in recent weeks have helped underpin risk appetite.

Wall Street’s main indexes are on track for modest weekly gains, with the benchmark S&P 500 about 1% shy of its record high.

The standout was the domestically focused small-cap index, which jumped 1.2%, outpacing the broader market as traders rotated into rate-cut beneficiaries.

Hewlett Packard Enterprise fell 9.7% after forecasting first-quarter revenue below estimates, as it sees a fall in AI server income due to customers shifting their orders to the second half of the year.

Oklo fell 5% after the nuclear technology firm unveiled a planned $1.5 billion share sale.