Wall Street’s main indexes dropped on Friday after a much stronger-than-expected employment report signaled that the labor market remains robust, dimming hopes of a September start to policy easing by the U.S. Federal Reserve.

The Labor Department’s report showed Nonfarm Payrolls rose by 272,000 jobs in May, against expectations of an increase of 185,000. Average hourly earnings rose 0.4% on a monthly basis, compared to an expectation of 0.3% growth.

Interest rate traders slashed bets on a September rate reduction, now seeing a roughly 56% chance, versus 68% before the data, according to the CME’s FedWatch tool.

“It’s the type of report that’s not going to cause the Fed to want to change the course that it has been on, which is to describe the need for higher interest rates and the potential for strong job creation to keep upward pressure on inflation,” said Brian Nick, senior investment strategist at The Macro Institute.

However, the unemployment rate rose to 4%, versus an expected 3.9%. Nonfarm Payroll numbers for April and March, too, were revised lower.

“The fact that you have these two figures, saying such different things, makes it very hard for investors and even harder for central bankers to know exactly what’s going on,” Nick said.

Wall Street mixed as Nvidia retreat hits tech stocks

All eight S&P 500 sectors were in decline, led by rate-sensitive real-estate stocks. The small-cap Russell 2000 index dropped 0.7% to a one-month low, while the PHLX Housing Index fell 1.4%.

Friday’s numbers pointed to underlying strength in the U.S. labor market, offsetting a string of data over the past two weeks that indicated potential weakness and caused investors to increase bets on a September rate cut.

Among individual names, GameStop dropped 1.7% in volatile trading after announcing a potential stock offering and a drop in quarterly sales. The retailer’s shares after stock influencer “Roaring Kitty” looked set to return to YouTube.

Other so-called meme stocks also fell, with AMC Entertainment and Koss Corp down 2.4% and 4.3%, respectively. Retail-focused trading platform Robinhood gained 1.0%.

At 9:45 a.m. ET, the Dow Jones Industrial Average was down 9.24 points, or 0.02%, at 38,876.93, the S&P 500 was down 9.05 points, or 0.17%, at 5,343.91, and the Nasdaq Composite was down 49.22 points, or 0.29%, at 17,123.91.

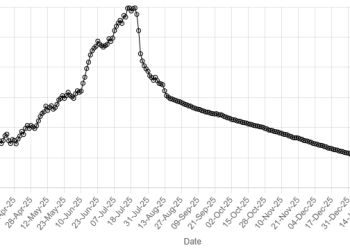

American Dollar Exchange Rate

American Dollar Exchange Rate