Wall Street benchmarks slumped on Thursday, ending with the largest single-day percentage losses in years, as U.S. President Donald Trump’s sweeping tariffs ignited fears of an all-out trade war and a global economic recession.

A combined $2.4 trillion in stock market value was wiped off of S&P 500 companies, as the benchmark suffered its largest one-day percentage decline since June 2020.

The Dow Jones Industrial Average has also not had a worse one-day collapse since June 2020, while the Nasdaq Composite posted its largest percentage decline on any day since the coronavirus pandemic sent global markets into a tailspin in March 2020.

The trigger was Trump’s 10% tariff on most U.S. imports and much higher levies on dozens of other countries, which threaten to unleash a global economic upheaval.

Investors sold positions to reflect the new economic reality, with concerns about how other countries would react to Trump’s proclamations from the White House.

China vowed retaliation, as did the European Union, which faces a 20% duty. South Korea, Mexico, India and several other trading partners said they would hold off for now as they seek concessions before the targeted tariffs take effect on April 9.

Trump sparks trade war with sweeping global tariffs

Wild swings are expected in the coming days: the CBOE Volatility index, known as Wall Street’s fear gauge, closed above 30 points for the first time since August.

“There are still a lot more questions than answers out here,” said Steven DeSanctis, small and mid-cap strategist at Jefferies Financial Group.

The S&P 500 lost 274.45 points, or 4.84%, at 5,396.52 points, while the Nasdaq Composite dropped 1,050.44 points, or 5.97%, to 16,550.61. The Dow Jones Industrial Average fell 1,679.39 points, or 3.98%, to 40,545.93.

The tariff-triggered bloodbath on Wall Street stood in stark contrast to the initial optimism after Trump’s reelection in November, when the promise of business-friendly policies propelled U.S. stocks to record highs.

High-flying technology stocks, which had helped push benchmarks to record highs in recent years, suffered heavily on Thursday.

Apple sank 9.2%, its worst one-day performance in five years, reeling from an aggregate 54% tariff on China, the base for much of the iPhone maker’s manufacturing. Nvidia slumped 7.8%, and Amazon.com dropped 9%.

Traders are ramping up expectations for the Federal Reserve to cut interest rates.

“The Fed does have considerable firepower to help the market,” said George Bory, chief investment strategist for the fixed income team at Allspring Global Investments.

“The market is now pricing in more rate cuts, and perhaps sooner,” adding an easing in June now seemed guaranteed, with the chance of a cut in May as well.

China’s yuan ends at 1-month low as markets brace for Trump’s tariff plan

That heightens the significance of Friday’s payrolls data and Fed Chair Jerome Powell’s speech the same day, which could offer crucial insights into the U.S. economy’s health and the future path of interest rates.

Retailers were hit hard, with Nike and Ralph Lauren falling 14.4% and

6.3%, respectively, on a raft of new tariffs on major production hubs including Vietnam, Indonesia and China.

Big banks, which are sensitive to economic risks, fell. Citigroup, Bank of America, and JPMorgan Chase & Co all dropped between 7% and 12.1%.

The U.S. small-cap Russell 2000 index tumbled 6.6%, its worst one-day drop since the pandemic’s onset, underscoring concerns about the health of the domestic economy.

“Small-cap companies tend to be suppliers to the large-cap companies, so as things go bad for the large-cap names because of tariffs, they are going to put a lot of pressure on their small-cap suppliers,” said Jefferies’ DeSanctis.

The energy index sank 7.5%, the heaviest decliner among the 11 S&P sectors, as crude prices slumped 6.8% on the tariffs and OPEC+ speeding up output hikes.

The one sector not in the red was consumer staples, which gained 0.7%. Traditionally considered adefensive play, it was also buoyed on Thursday by Lamb Weston, which advanced 10% after reporting earnings.

Volume on U.S. exchanges was 20.90 billion shares, compared with the 16.13 billion average for the full session over the last 20 trading days.

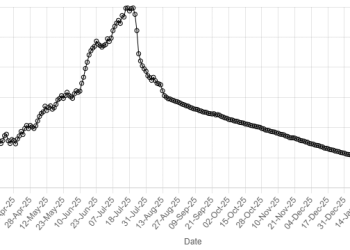

American Dollar Exchange Rate

American Dollar Exchange Rate