Wall Street’s main indexes were mixed on Tuesday as the recent tech-fueled rally took a breather, while investors awaited Federal Reserve Chair Jerome Powell’s remarks on the economy amid conflicting signals from policymakers.

Powell’s comments could be crucial to shaping interest rate expectations at a time when the Fed’s rate cut last week has lifted equities and investors are hoping for further reductions to sustain the rally.

Some officials argue for measured cuts going forward to keep inflation in check. Chicago Fed President Austan Goolsbee said on Tuesday that if inflation cools off the central bank has some space to cut its interest rate target.

“The market is pricing two more cuts this year. That could potentially be at risk if there is a little bit of a hawkish tilt this week, especially from Powell,” said Charlie Ripley, senior investment strategist for Allianz Investment Management.

At 10:13 a.m. ET, the Dow Jones Industrial Average rose 306.42 points, or 0.66%, to 46,687.96, the S&P 500 gained 3.43 points, or 0.05%, to 6,697.18 and the Nasdaq Composite lost 52.76 points, or 0.23%, to 22,734.72.

The S&P 500 financials sector hit a record high and was last up 0.9%, while energy companies rose 2.3%. The gains helped the benchmark index hit an intraday all-time high.

Losses in Nvidia which slipped 2.2% after hitting an intraday record high in the previous session, and Amazon.com down 2.3%, weighed on the Nasdaq.

Technology stocks fell 0.5% on the S&P 500.

Gains in Boeing and banks such as Goldman Sachs and JPMorgan boosted the Dow to hit an intraday record high.

Boeing gained 3.4% after securing an order from Uzbekistan Airways worth over $8 billion, while talks for a Chinese order were ongoing.

A September reading of S&P Global’s flash manufacturing PMI fell to 52 from 53 in August.

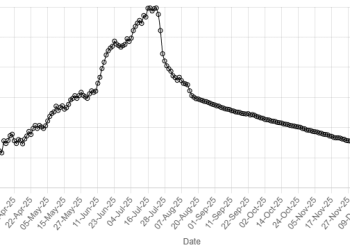

Part of Wall Street’s resilience in September, a historically weak month for equities, can be traced to strength in technology stocks and renewed optimism around artificial intelligence-linked trading.

Some analysts have, however, raised concerns of stretched stock valuations. Others argued that markets could sustain their current multiples if the upcoming earnings season passes without any red flags.

“An accommodative Fed and an economy that accelerates into 2026 should allow the market to maintain its current multiple, leaving earnings growth to drive continued U.S. equity gains,” Goldman Sachs analysts wrote in a note.

During the past 40 years, the S&P 500 has generated a 15% median 12-month return when the Fed resumed cutting rates against a backdrop of continued economic growth.

However, uncertainty around the Trump administration’s policy continues to pose risks. Kenvue the maker of popular pain medication Tylenol, rose 3.9%but is yet to fully recover from a 7.5% plunge on Monday when the U.S. president linked autism to childhood vaccine use and the taking of Tylenol by women when pregnant.

Advancing issues outnumbered decliners by a 2.84-to-1 ratio on the NYSE and by a 1.85-to-1 ratio on the Nasdaq.

The S&P 500 posted 36 new 52-week highs and eight new lows, while the Nasdaq Composite recorded 109 new highs and 21 new lows.