U.S. stock indexes rose on Friday, on track to end October with solid gains, as Amazon’s upbeat earnings outlook helped ease jitters around AI overspending.

Amazon shares jumped 11% to an all-time high after the online retailer forecast quarterly sales above estimates, helped by cloud revenue rising at the fastest clip in nearly three years.

Apple’s forecast for iPhone sales in the holiday quarter surpassed Wall Street expectations, but CEO Tim Cook flagged supply constraints. Its shares were last down 0.3%.

Nvidia which became the first publicly listed firm to surpass $5 trillion in market value earlier this week, rose 1.6% after CEO Jensen Huang said he hoped the company’s state-of-the-art Blackwell chips can be sold in China.

AI frenzy pushed Wall Street to record highs earlier this week before concerns about major spending from Microsoft and Meta as well as doubts about further interest rate cuts from the Federal Reserve spooked investors.

Still, for the month, the S&P 500 was up 2.6%, putting it on track for a sixth straight monthly gain – its longest such streak since August 2021.

The Nasdaq Composite was on pace for a seventh consecutive monthly advance, while the Dow was set for its sixth straight monthly win – their longest runs since January 2018.

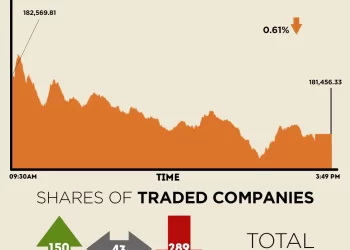

At 10:50 a.m. ET, the Dow Jones Industrial Average rose 111.01 points, or 0.23%, to 47,633.13, the S&P 500 gained 43.27 points, or 0.63%, to 6,865.61 and the Nasdaq Composite gained 282.67 points, or 1.20%, to 23,863.81.

While expectations for faster U.S. rate cuts buoyed stocks earlier in the month, markets are still adjusting to a shift in policy outlook after the central bank delivered a widely expected quarter-point rate cut but signaled that another move in December was not a “foregone conclusion”.

Odds of a 25 bps cut in December have fallen since, with traders now pricing in a 62.8% chance of such a move versus 91% just a week ago.

“Recently we’ve kind of seen an everything rally, and that’s because we are getting into this area where interest rates start to matter and interest rates are going lower,” said Dennis Dick, chief strategist at Stock Trader Network.

“The market believes that the next Fed meeting is probably going to be a lot more dovish than Powell was.”

Of the 278 S&P 500 companies that have reported third-quarter results so far, 83.1% have surpassed analysts’ estimates, according to LSEG data. That’s well above the historical average, where roughly 67% of firms beat forecasts.

In other moves, Warner Bros Discovery rose 3.5% following a Reuters report that Netflix was actively exploring a bid for the company’s studio and streaming business.

Netflix added 3.7% as it unveiled plans for a 10-for-1 stock split.

Getty Images rose 14% after signing a global multi-year licensing agreement with Perplexity AI.

Western Digital jumped 7.3% to an all-time high after forecasting quarterly earnings above Wall Street estimates.

Solar panel maker First Solar surged 12.9% to a more than one-year high after surpassing expectations for third quarter sales.

Advancing issues outnumbered decliners by a 1.45-to-1 ratio on the NYSE, and by a 1.59-to-1 ratio on the Nasdaq.

The S&P 500 posted 15 new 52-week highs and 33 new lows while the Nasdaq Composite recorded 50 new highs and 113 new lows.