CHICAGO: The following are U.S. expectations for the resumption of grain and soy complex trading on Thursday.

Wheat – Down 1 to 3 cents per bushel

Wheat futures pared losses as wheat crop forecasts in Ukraine and the European Union fell.

Ukraine’s 2025 grain harvest is likely to fall to 51-52 million metric tons from about 55 million tons in 2024, mostly owing to poor weather, the deputy head of Ukraine’s largest farm union said on Thursday.

The European Commission trimmed its forecast for usable production of both soft wheat and maize (corn) in the European Union in 2025/26.

CBOT September soft red winter wheat was last down 1-1/2 cents at $5.22-1/4 per bushel. K.C. September hard red winter wheat was last up 1-1/2 cents at $5.23-1/2 per bushel. Minneapolis September wheat was last down 1-1/4 cents at $5.76 a bushel.

Wheat down 4-5 cents, corn down 2-3, soybeans down 6-7

Corn – Down 1 to 2 cents per bushel

Corn futures ticked down, pressured by ongoing favorable weather in the U.S. Midwest corn belt but supported by technical buying and demand.

On Thursday, the U.S. Department of Agriculture is expected to report weekly U.S. corn export sales of 200,000 to 800,000 metric tons for 2024-25 and of 600,000 to 1.6 million metric tons for 2025-26, analysts said.

Demand from Asia has been brisk as corn prices have been weak.

Milder temperatures and periodic showers into early August are expected to benefit Midwest corn, according to Commodity Weather Group.

CBOT December corn fell 1-3/4 at $4.10-1/2 per bushel.

Soybeans – Down 1 to 2 cents per bushel

Soybean futures fell on beneficial weather in the U.S. Midwest, abundant global supplies and sluggish Chinese demand.

In top soy buyer China, demand for soybeans is expected to remain subdued during the peak U.S. marketing season later this year.

Cooler temperatures and occasional showers in the U.S. Midwest are expected to favor the nation’s soy crop through early August, according to Commodity Weather Group.

CBOT November soybeans were last down 1-1/2 cents at $9.94-1/4 per bushel.

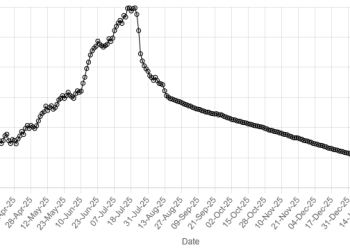

American Dollar Exchange Rate

American Dollar Exchange Rate