DUBAI: Saudi Arabia’s Public Investment Fund is combining two giga project developers on the Red Sea coast to “leverage synergies” as the Kingdom goes ahead with ambitious tourism goals.

The consolidation deal will see The Red Sea Development Co. (TRSDC) taking over Amaala, both owned by the PIF, but the tourist destinations they are developing will retain “separate, distinct” identities, Chief Executive Officer John Pagano told Arab News.

“Amaala has its own unique positioning and branding, which is not going to change, as well as the Red Sea project,” he said on the sidelines of the Arabian and African Hospitality Investment conference in Dubai

Pagano added: “Amaala is focused on wellness, while the Red Sea project is very much focused on eco-tourism – that is not going to change.”

It follows a move that saw Pagano being appointed as the CEO of Amaala in January this year.

“We said we would look at the way at which we could combine the organizations, and look to leverage synergies between the two groups,” Pagano said.

He explained: “We are going to leverage the unique skill sets that both project teams have and use them for the better good of both projects.”

The consolidation will also allow both destinations to boost operational efficiencies, he added.

There was no value to the transaction, Pagano said, describing the move as just a consolidation of two companies, which are both owned by one entity anyway.

‘Regenerative tourism’

The Red Sea Development Co. alone is building over 28,000 square kilometers of land and water along the Kingdom’s west coast. It will feature mountain canyons, dormant volcanoes, as well as ancient and cultural heritage sites.

Its first phase is expected to be finished by 2023, where 16 hotels will be opened. The project targets some 50 resorts with 8,000 hotel rooms by 2030.

These massive plans have raised questions from environment advocates, but Pagano maintains regeneration remains a key component of the project.

“Sustainability is no longer enough. We have moved our narrative to regeneration,” he said.

Pagano said it is not simply just about “causing no harm” to the environment, but actively looking for ways to improve the destination and “leave it in a better state than we found it.”

The company has announced a number of initiatives to keep this promise – from small regulations such as banning single-use plastic to big operational plans including using renewable energy to power the destination.

“We are going to be the largest tourism destination in the world powered by 100 percent renewable energy – 24 hours a day, completely off-grid,” Pagano said.

To achieve this, Pagano said they are installing what he claims to be the largest battery storage system in the world.

The company also engages in improving biodiversity on the Red Sea, including working with the scientific community to grow corals.

This level of commitment is also shared by international brands who plan to invest in the Red Sea project, Pagano said, as the bigger hotel industry becomes more conscious about global environmental goals.

“International brands support our vision, otherwise we would not be dealing with them,” he said. These brands will be announced at the Future Investment Initiative summit in Riyadh next month.

Financing the ambition

The CEO said they “will come to market next year with a similar approach for Amaala,” referring to the $3.7 billion financing it secured in April that already covered capital infrastructure for the Red Sea project’s first phase.

“It will be a senior debt facility – conventional finance – that’s what we need at this stage. It will come in the not-so-distant future,” he said.

Pagano said they have already built credibility with lending institutions, which he expects will make it easier for them to secure financing.

According to a Reuters report, Saudi Arabia is planning to raise up to 10 billion riyals ($2.67 billion) next year for Amaala, citing the CEO.

‘Saudi Arabia is changing’

All these projects are part of an ongoing transformation in the Kingdom, primarily driven by its pursuit to diversify income sources away from oil.

The Kingdom identified tourism as one of its key sectors in this diversification, with many infrastructure developments in the pipeline, as well as regulatory changes that make it easier for tourists to visit the previously closed-off Gulf state.

“It is fair to say that Saudi Arabia is changing from a policy perspective, and it’s changing dramatically,” Pagano said.

For the Red Sea destinations, Pagano said they are building a special economic zone that will set a more relaxed regulatory environment.

“It will be conducive to attracting investments, and it is going to allow us to adjust the social norms to make the destinations attractive to foreign visitors,” he said.

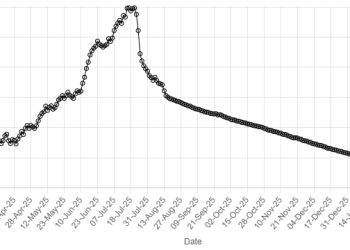

American Dollar Exchange Rate

American Dollar Exchange Rate