HONG KONG: China’s yuan eased against the US dollar on Friday, pulling back from a two-week high, as weaker-than-expected economic readings weighed on sentiment.

Data on Friday showed a loss of momentum in the Chinese economy, with factory output growth falling to an eight-month low in July and retail sales slowing sharply, heaping pressure on policymakers to introduce further stimulus to revive domestic demand and cushion against US trade pressure.

By 0327 GMT, the yuan was 0.05% lower at 7.1828 to the dollar.

The offshore yuan traded at 7.1858 yuan per dollar, down about 0.04%.

Despite signs of stress in Chinese economic data, the yuan is up 0.3% against the dollar this month with trade relations between Washington and Beijing having shown signs of de-escalation with a 90-day tariff truce extension.

The dollar has also been softening on expectations of US interest rate cuts next month.

Persistent structural challenges and disinflation pressures in China’s economy suggest limited room for fast yuan appreciation, analysts at LGT Private Banking Asia said in a note.

Prior to the market opening, the People’s Bank of China set the midpoint rate at 7.1371 per dollar, 481 pips firmer than a Reuters’ estimate.

The spot yuan is allowed to trade by as much as 2% on either side of the fixed midpoint each day. Based on Friday’s official guidance, the yuan would be allowed to drop as far as 7.2798.

The dollar was steady after the US producer prices registered the quickest rise in three years in July amid a surge in the costs of goods and services.

The odds of a 25-basis-point cut by the US central bank retreated slightly after the producer price figures, per CME’s FedWatch tool.

Reuters

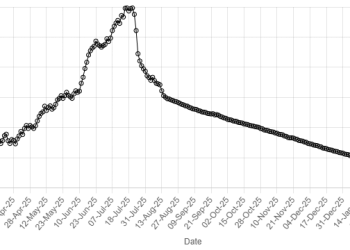

American Dollar Exchange Rate

American Dollar Exchange Rate