Oil prices fell on Tuesday as traders weighed the prospect of higher Venezuelan crude output following the US capture of President Nicolas Maduro, adding to expectations of ample global supply this year amid weak demand.

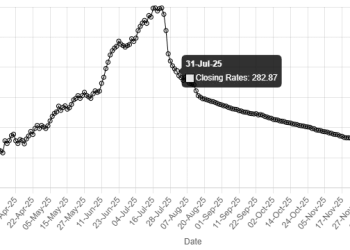

Brent crude futures fell 0.2% to $61.62 a barrel by 0103 GMT while US West Texas Intermediate crude was at $58.15 a barrel, down 0.3%.

“I think if the Trump playbook even partially comes to pass, Venezuelan crude oil production should increase… Should it increase, there will be more pressure on an already over supplied market,” said Marex analyst Ed Meir.

Market participants polled by Reuters in December already expected oil prices to be under pressure in 2026 due to growing supply and weak demand.

Price pressure is now likely to be exacerbated by the US capture of Venezuela’s leader on Saturday which increases the chance of an end to a US embargo on Venezuelan oil and the likelihood of more output.

The administration of US President Donald Trump plans to meet US oil executives this week to discuss boosting Venezuelan oil production, a person familiar with the matter told Reuters.

Oil benchmarks settled more than 1% higher in the previous trading session, as investors digested news of Maduro’s capture and US comments about taking control of Venezuela.

Maduro pleaded not guilty on Monday to narcotics charges. Venezuela is a founding member of the Organization of the Petroleum Exporting Countries and has the world’s largest oil reserves at about 303 billion barrels.

However, its oil sector has long been in decline due in part to under-investment and US sanctions.

Its average output last year was 1.1 million barrels per day.

Oil analysts said Venezuelan output could increase by as much as half a million barrels a day over the next two years if there is political stability and US investment.

“Longer term, the US administration’s stated desire to drive up Venezuelan oil supply is likely to provide a net bearish impulse to the market,” Citi said in a client note.

“Importantly we continue to think that OPEC+, led by Saudi Arabia, will likely respond to any significant rise in inventories by cutting output to protect $55-60/bbl Brent over the medium term should supply surprise to the upside.”

At a short meeting on Sunday, OPEC and its allies, known as OPEC+, agreed to maintain output levels.