MUMBAI: India is piling into consumer giants’ basket of troubles. Unilever and Nestléare losing pricing power in the world’s fifth-largest economy amid growing competition from nimble upstarts. It’s an unwelcome headache for the groups that are trying to revive their more established markets in Europe and the U.S. With no easy fixes, the problem may require expensive remedies.

Consumer titans were once synonymous with boringly predictable earnings. But a recent bout of management churn and intense competition has made them about as predictable as the start-ups they are now battling for market share. Last February, $140 billion Unilever replaced its CEO Hein Schumacher with its finance chief Fernando Fernandez to accelerate its growth plans. It also grappled with rising commodity prices and spun out its ice cream unit at a disappointing valuation.

Nestlé is enduring an even trickier time. The $240 billion Kitkat maker is on its third CEO in less than three years and is dealing with a decline in sales in Europe and the U.S. These factors have weighed on the groups’ share prices which are flat versus the same period last year, underperforming Europe’s Stoxx 600 which is up nearly 20% in the same period.

In ordinary times, these groups could rely on their Indian businesses to compensate. Indeed, historically they performed better than their parents’ businesses in developed markets. At its 2016 peak, sales at Nestlé India grew nearly 16%, eight times the pace of the Swiss group’s European business and four times that of its Americas unit. As recently as 2021, Hindustan Unilever was growing turnover at a punchy 18% as Europe and the Americas only managed under 5%.

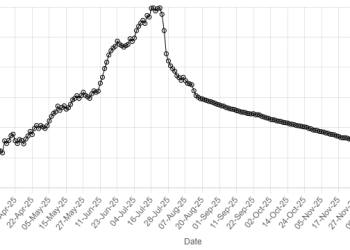

But those dynamics are changing. During the year ended March 2025 sales at HUL grew just 2%,, down from double digits two years earlier. Meanwhile, Nestlé ’s Indian business grew 1%, in 2024. That run rate means India can barely contribute much more to these groups’ top lines than it currently does – 2% and 11% for Nestlé and Unilever respectively.

More concerning for investors, however, is the effect this is having on these groups’ profitability. EBITDA margins of Hindustan Unilever and Nestlé India are off pandemic-era peaks and could remain below those levels at least until 2027, according to forecasts compiled by Visible Alpha.

The bosses of these businesses blame the recent weakness on rising commodity prices and high inflation which, coupled with stagnating incomes in the aftermath of Covid, have diminished Indians’ purchasing power.

The danger for investors is the decline may intensify. Affluent urban Indians are increasingly shopping for essentials on e-commerce platforms Eternal and Swiggy, which use a network of mini warehouses to deliver everything from milk to umbrellas in 10 minutes. These apps enable challenger brands like Honasa Consumer’s Mamaearth and Investment Corporation of Dubai-backed snackmaker Slurrp Farm to display their brands alongside legacy names like Sunsilk and KitKat, robbing Unilever and Nestlé of their storied distribution edge.

Big groups also missed the boat on premiumisation. Indian consumers have become aspirational. That’s birthed whole categories from grooming products to pancake mixes that Unilever, Nestlé and their large rivals are struggling to compete in.

Amid these forces, consumer group boardrooms face two unpalatable choices. They can jack up prices to protect margins but are likely to lose market share in the hypercompetitive Indian market. Alternatively, they can sacrifice margins to boost growth but that means fewer spoils to share with investors.

The first option hardly seems feasible as smaller and more agile rivals are only likely to take more market share from larger groups. Meanwhile, demand for private labels is growing which will put even more pressure on pricing. For now, investors may have to accept lower margins as Unilever and Nestlé try to protect their businesses and invest more heavily in new products.

The risks are plain to see in these groups’ valuations. HUL now trades at 47 times forward earnings, down from 65 times in 2021 and lagging supermarket chain Avenue Supermarts’ 69 times.

For now, there are no easy fixes. Launching their own quick commerce offerings makes little sense for consumer giants as users of the existing apps are proving increasingly sticky. A less immediate but more effective way to counter the loss of pricing power is to rejig their product mix. HUL and Nestlé will have to ensure their presence across categories and locations so that consumers rising up the value chain choose their brands over upstarts. A bigger investment in agile AI-enabled tracking of sales trends at mom-and-pop retailers could help with that.

Acquiring fast-growing brands is another option. HUL’s 2025 purchase of personal care brand Minimalist valued its target at 9 times its trailing sales, on par with its own multiple. But buying one of India’s top online platforms is out of the question: Eternal and Swiggy are delivery service-based companies that would be a clunky fit in these sprawling manufacturing businesses.

Businesses may also need to rethink marketing in a country where close to two-thirds of the population is under the age of 35 and shopping choices are increasingly based on influencer recommendations. HUL spent 10% of its revenue on sales and marketing in the year to March 2025, while its personal-care rival Honasa shelled out 57%. If the Unilever unit raised marketing spend by 10%, its EBITDA margin would go down 87 basis points, Breakingviews calculations based on Visible Alpha estimates show.

To be sure, all these options involve squeezing margins in the short term to ensure staying power in a crowded market. For now, consumer giants will have to add India to their growing list of fixer upper projects.