SYDNEY: The Australian and New Zealand dollars held onto overnight gains on Thursday after snapping a five-day losing streak, as global stocks staged a comeback to counter worries about stretched valuations.

The Aussie was flat at $0.6502, having been up from a three-week low of $0.6459 overnight to squeeze out a small gain of 0.3%, the first in six sessions.

It was, however, still battling sellers at the 65 cent level and was nowhere near its recent peak of $0.6617.

The kiwi was off 0.1% to $0.5657 after rising 0.4% overnight to move away from a seven-month trough of $0.5631.

Apart from a resurgent US dollar, it has also been feeling some added weight from hopes for more policy easing from the Reserve Bank of New Zealand.

Overnight, US stocks bounced following a sharp sell-off a day earlier as investors waded back into technology stocks.

“The rebound in the AUD/USD, which came from just ahead of a band of important medium-term support 0.6445, keeps the AUD/USD’s uptrend intact and with it the ability to retest the recent 0.6617 high,” said Tony Sycamore, an analyst at IG.

Against the kiwi, the Aussie held at NZ$1.1478, having hit a 12-year high of NZ$1.1503 on Wednesday. It is up almost 4% this year.

There is a risk that the Reserve Bank of Australia might be done easing after leaving rates steady at 3.6% on Tuesday, while markets have fully priced in a quarter-point rate cut from the RBNZ later this month, with some betting on a 50 bp move after a weak jobs report.

On Wednesday, Citi called for a 50 bp cut from the RBNZ in November. “We see this as a ‘path of least regrets,’” Citi analysts said in a note to clients.

“A 50 bps cut does not risk stoking inflationary pressures … moreover, the large meeting gap between November and February does make 50bps move more likely.”

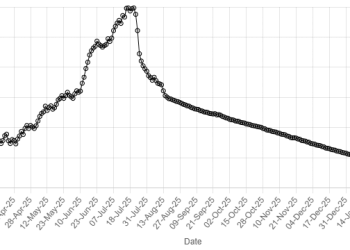

American Dollar Exchange Rate

American Dollar Exchange Rate