SHANGHAI: The yuan headed for its longest string of monthly gains against the dollar in four years on Friday, even as traders turned more cautious about taking the Chinese currency higher amid signs the central bank wants to cool its advance.

The onshore yuan edged up less than 0.1% to 7.0756 per dollar as of 0415 GMT, keeping it on course for a 0.6% appreciation for November, which would be a fourth straight monthly rise.

The yuan touched a 13-month peak of 7.0738 on Thursday before pulling back.

Its offshore counterpart traded at 7.0712 per dollar, and was also on track for a fourth consecutive monthly increase.

Prior to the market open, the People’s Bank of China (PBOC) set the official midpoint rate at 7.0789 per dollar, 20 pips weaker than a Reuters’ estimate of 7.0769. It was the second day in a row that the central bank’s official guidance was weaker than market projections.

Market participants closely watch the daily fixing for subtle signals about the PBOC’s stance on the foreign exchange market.

The spot yuan is allowed to trade a maximum of 2% either side of the midpoint each day.

A strong yuan may not be justified by China’s macroeconomic backdrop, with a string of recent data pointing to persistently weak domestic demand, traders and analysts said.

Friday’s small gains for the Chinese yuan were more the product of a broadly softer dollar, traders said, with the greenback heading for its worst weekly performance in four months. Liquidity was also thinned by the US Thanksgiving holiday.

“Near-term USD/CNY moves will hinge on the dollar trend,” Morgan Stanley analysts said in a note.

They expect the yuan’s movements to be affected by the US Federal Reserve’s monetary easing trajectory, predicting the yuan to rise to the psychologically important 7.0 per dollar level by mid-2026 before weakening to 7.05 by the end of 2026.

Separately, cash conditions in the interbank market showed signs of loosening on Friday, with the volume-weighted average rate of the overnight repo falling to a more than two-year low of 1.2935%.

Traders said they will be watching November factory activity data due on Sunday for more clues on the health of the economy, before focusing on the Central Economic Work Conference (CEWC) next month for possible hints on the policy agenda for next year.

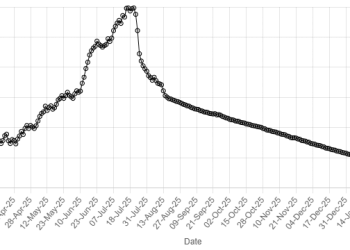

American Dollar Exchange Rate

American Dollar Exchange Rate