MUMBAI: Indian government bonds declined on Tuesday, as Bloomberg Index Services held off including Indian debt in its global index, surprising traders as they had already factored it into prices, and added that the review for inclusion was open and ongoing.

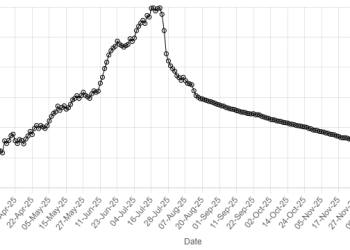

The benchmark 10-year yield ended at 6.6277% after ending at 6.6050% on Monday. Bond yields move inversely to prices.

Bloomberg Index Services deferred the inclusion of Indian bonds in its flagship Global Aggregate Index, disappointing investors that had considered the inclusion a done deal.

The index provider said a number of respondents highlighted important operational and market-infrastructure considerations that merit further evaluation before inclusion.

“The decision disappointed markets that had largely priced in inclusion this month, with expectations of up to $25 billion in inflows over 10 months,” Harsimran Sahni, head of treasury at Anand Rathi Global Finance said.

“This deferral comes as a surprise given that Indian bonds have steadily gained entry in major emerging market benchmarks.”

Market players had been anticipating bonds under fully accessible route joining the index, potentially leading to inflows of $10 billion to $25 billion.

Still, the rise in yields was capped after marginally better-than-expected demand from long-term investors for 268.15 billion rupees ($2.97 billion) of state bonds.

Focus remains on geopolitical risks and higher oil prices due to potential supply disruptions.

RATES

India’s overnight index swap rate moved higher, led by the longer end of the swap curve, tracking rise in bond yields.

The one-year OIS rose by 1.75 bps to 5.5050%, while the two-year OIS rate closed 1.5 bps higher at 5.5850%. The liquid five-year OIS rate jumped about 3.25 bps to settle at 5.9625%.