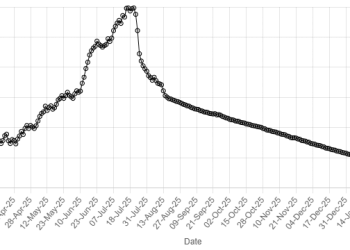

BEIJING: Iron ore futures prices fell on Friday as a continuous fall in near-term China demand sparked renewed caution among investors, although expectations of improved intake in the coming peak construction season kept prices heading for a weekly gain.

The most-traded January iron ore contract on China’s Dalian Commodity Exchange (DCE) ended morning trade 1.09% lower at 728 yuan a metric ton.

It has gained 3% so far this week, but was still 22.3% lower from the beginning of the year.

The benchmark September iron ore on the Singapore Exchange was 0.15% lower at $97.2 a ton, as of 0333 GMT, a rise of 5.6% so far this week.

Output of hot metal, an indicator to gauge iron ore demand, continued its fall for a fifth consecutive week, showing that near-term ore consumption remained subdued, said analysts. Average daily hot metal output among steelmakers surveyed fell 1.9% on the week to 2.24 million tons as of Aug. 23, the lowest since early April, data from consultancy Mysteel showed.

Weighing on buying appetite for the key steelmaking ingredient is also widening loss suffering among Chinese steel mills.

Profitability among steelmakers dropped for seven consecutive weeks to 1.3% from 4.76% previously, Mysteel data also showed.

The weekly gain, however, came after the persistent and sharp price drops had propelled a wave of dip buying, especially ahead of ‘golden September’ when downstream construction activities typically pick up.

Iron ore climbs to one-week high

Iron ore fell to a more than one-year-low last week, dragged by the weakening steel market where prices of some steel products tumbled to multi-year lows as jitters amid panic sell-off triggered by the requirement to switch to new steel standards and protracted property woes weighed.

Steel benchmarks on the Shanghai Futures Exchange extended loss.

Rebar retreated 0.5%, hot-rolled coil slid 1.16%, wire rod lost 1.25% and stainless steel dipped 0.54%.

Other steelmaking ingredients on the DCE lost ground, with coking coal and coke down 1.77% and 0.4%, respectively.

American Dollar Exchange Rate

American Dollar Exchange Rate