The Pakistan Stock Exchange (PSX) is set for another year of gains, with Topline Securities projecting the benchmark KSE-100 Index to reach 203,000 points by December 2026, implying a total return of around 26%, including a 7% dividend yield.

The projection is based on a 2027 forward price-to-earnings (P/E) multiple of 7.6 times—up from the current 6.8 times—along with an expected earnings growth of 7%.

“In our view, the positive momentum of the market will continue in 2026 based on several triggers like (1) Qatar LNG cargoes deferment, (2) zero circular debt accumulation in both gas and power sectors, (3) likely clearance of the backlog of gas sector circular debt, (4) privatization of PIA, (5) launch of Eurobond/Sukuk and better credit rating, (6) implementation of new NFC formula, (7) relationships with India and Afghanistan, (8) financial close of Reko Diq and (9) likely reliefs in Pakistan Budget FY27 for exporters and other industries,” said Topline.

“Furthermore, the momentum in the market will be strongly supported by local investors’ conversions to equities from low-yielding fixed income investments. Besides this, investment avenues like other traditional assets (i.e. USD, gold, property) classes are currently either restricted/regulated or not attractive.”

The report also highlighted that equities now constitute 14% of mutual funds’ assets under management (AUMs), up from 7% in 2024, and could rise to 18–20% by the end of 2026 as interest rates remain lower.

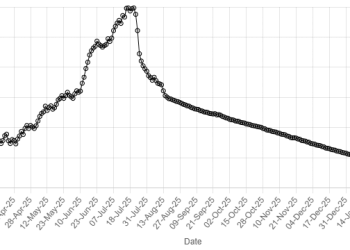

Topline expects Pakistan’s GDP growth to remain between 3–3.5% in FY26 and rise to 3.75–4.25% in FY27. The rupee is projected to trade in the range of Rs285–290 by mid-2026 and Rs290–295 by year-end.

“Fueled by floods, we expect inflation in the range of 6.5-7.5% during FY26, while in FY27 we expect inflation to clock in at 7.5-8.0% (0.56% MoM monthly),” it said.

Investor sentiment is also improving—93% of foreign investors polled expect positive returns in 2026, while 86% plan to maintain or increase exposure to Pakistan. Topline noted that with foreign ownership at a decade low and macro indicators stabilising, the PSX remains well-positioned for another year of growth.

American Dollar Exchange Rate

American Dollar Exchange Rate