JAKARTA: Malaysian palm oil futures tumbled for a fourth straight session on Tuesday, pressured by weakness in Dalian and Chicago edible oils and sluggish exports, while market participants assessed the flood situation in Malaysia.

The benchmark palm oil contract for February delivery on the Bursa Malaysia Derivatives Exchange was down 65 ringgit, or 1.6%, at 3,990 ringgit ($966.10)a metric ton at closing.

“Today, Malaysia crude palm oil future is trading in a tight range, tracking Dalian palm oils’ performance, while traders review the flood situation. So far, only northern Malaysia has been hit by heavy rains,” a Kuala Lumpur-based trader said.

More than 11,000 people in seven Malaysian states have been affected by flooding caused by torrential rain, the national disaster agency said on Monday.

Exports of Malaysian palm oil products in November 1-22 was seen falling between 16.4% and 18.8% from the same period a month ago, according to independent inspection company AmSpec Agri and cargo surveyor Intertek Testing Services.

Dalian’s most-active soyoil contract was down 0.37%, while its palm oil contract slid 1.69%. Soyoil prices on the Chicago Board of Trade were down 0.59%.

Palm oil tracks price movements in rival edible oils, as it competes for a share of the global vegetable oils market.

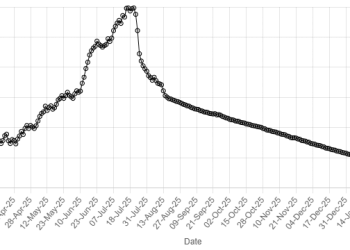

The ringgit, palm’s currency of trade, strengthened 0.22% against the dollar, making the commodity more expensive for buyers holding foreign currencies.

American Dollar Exchange Rate

American Dollar Exchange Rate