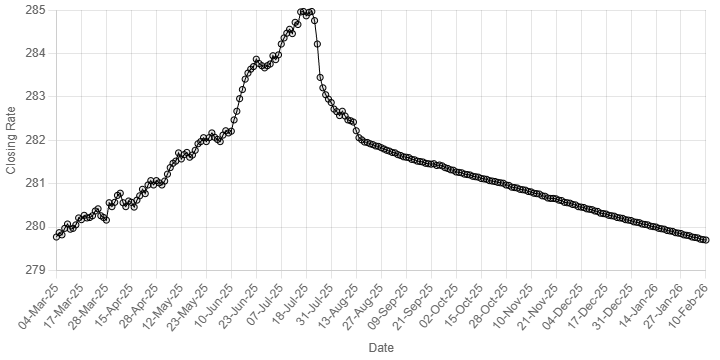

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”, “13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”, “10-Jun-25”, “11-Jun-25”, “12-Jun-25”, “13-Jun-25”, “16-Jun-25”, “17-Jun-25”, “18-Jun-25”, “19-Jun-25”, “20-Jun-25”, “23-Jun-25”, “24-Jun-25”, “25-Jun-25”, “26-Jun-25”, “27-Jun-25”, “30-Jun-25”, “02-Jul-25”, “03-Jul-25”, “04-Jul-25”, “07-Jul-25”, “08-Jul-25”, “09-Jul-25”, “10-Jul-25”, “11-Jul-25”, “14-Jul-25”, “15-Jul-25”, “16-Jul-25”, “17-Jul-25”, “18-Jul-25”, “21-Jul-25”, “22-Jul-25”, “23-Jul-25”, “24-Jul-25”, “25-Jul-25”, “28-Jul-25”, “29-Jul-25”, “30-Jul-25”, “31-Jul-25”, “01-Aug-25”, “04-Aug-25”, “05-Aug-25”, “06-Aug-25”, “07-Aug-25”, “08-Aug-25”, “11-Aug-25”, “12-Aug-25”, “13-Aug-25”, “15-Aug-25”, “18-Aug-25”, “19-Aug-25”, “20-Aug-25”, “21-Aug-25”, “22-Aug-25”, “25-Aug-25”, “26-Aug-25”, “27-Aug-25”, “28-Aug-25”, “29-Aug-25”, “01-Sep-25”, “02-Sep-25”, “03-Sep-25”, “04-Sep-25”, “05-Sep-25”, “08-Sep-25”, “09-Sep-25”, “10-Sep-25”, “11-Sep-25”, “12-Sep-25”, “15-Sep-25”, “16-Sep-25”, “17-Sep-25”, “18-Sep-25”, “19-Sep-25”, “21-Sep-25”, “22-Sep-25”, “23-Sep-25”, “24-Sep-25”, “25-Sep-25”, “26-Sep-25”, “29-Sep-25”, “30-Sep-25”, “01-Oct-25”, “02-Oct-25”, “03-Oct-25”, “06-Oct-25”, “07-Oct-25”, “08-Oct-25”, “09-Oct-25”, “10-Oct-25”, “13-Oct-25”, “14-Oct-25”, “15-Oct-25”, “16-Oct-25”, “17-Oct-25”, “20-Oct-25”, “21-Oct-25”, “22-Oct-25”, “23-Oct-25”, “24-Oct-25”, “27-Oct-25”, “28-Oct-25”, “29-Oct-25”, “30-Oct-25”, “31-Oct-25”, “03-Nov-25”, “04-Nov-25”, “05-Nov-25”, “06-Nov-25”, “07-Nov-25”, “10-Nov-25”, “11-Nov-25”, “12-Nov-25”, “13-Nov-25”, “14-Nov-25”, “17-Nov-25”, “18-Nov-25”, “19-Nov-25”, “20-Nov-25”, “21-Nov-25”, “24-Nov-25”, “25-Nov-25”, “26-Nov-25”, “27-Nov-25”, “28-Nov-25”, “01-Dec-25”, “02-Dec-25”, “03-Dec-25”, “04-Dec-25”, “05-Dec-25”, “08-Dec-25”, “09-Dec-25”, “10-Dec-25”, “11-Dec-25”, “12-Dec-25”, “15-Dec-25”, “16-Dec-25”, “17-Dec-25”, “18-Dec-25”, “19-Dec-25”, “22-Dec-25”, “23-Dec-25”, “24-Dec-25”, “26-Dec-25”, “29-Dec-25”, “30-Dec-25”, “31-Dec-25”, “02-Jan-26”, “05-Jan-26”, “06-Jan-26”, “07-Jan-26”, “08-Jan-26”, “09-Jan-26”, “12-Jan-26”, “13-Jan-26”, “14-Jan-26”, “15-Jan-26”, “16-Jan-26”, “19-Jan-26”, “20-Jan-26”, “21-Jan-26”, “22-Jan-26”, “23-Jan-26”, “26-Jan-26”, “27-Jan-26”, “28-Jan-26”, “29-Jan-26”, “30-Jan-26”, “02-Feb-26”, “03-Feb-26”, “04-Feb-26”, “06-Feb-26”, “09-Feb-26”, “10-Feb-26”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17, 282.21, 282.47, 282.67, 282.96, 283.17, 283.41, 283.55, 283.64, 283.70, 283.87, 283.77, 283.72, 283.67, 283.72, 283.76, 283.95, 283.86, 283.97, 284.22, 284.36, 284.47, 284.56, 284.46, 284.72, 284.67, 284.96, 284.97, 284.87, 284.95, 284.97, 284.76, 284.22, 283.45, 283.21, 283.05, 282.95, 282.87, 282.72, 282.66, 282.57, 282.67, 282.56, 282.47, 282.45, 282.42, 282.22, 282.06, 282.01, 281.96, 281.95, 281.92, 281.90, 281.87, 281.86, 281.83, 281.8, 281.77, 281.75, 281.72, 281.71, 281.67, 281.65, 281.62, 281.61, 281.60, 281.56, 281.55, 281.52, 281.51, 281.50, 281.47, 281.46, 281.45, 281.46, 281.42, 281.43, 281.41, 281.37, 281.35, 281.32, 281.31, 281.27, 281.26, 281.25, 281.22, 281.21, 281.20, 281.17, 281.16, 281.15, 281.12, 281.11, 281.10, 281.07, 281.06, 281.05, 281.03, 281.02, 281.01, 280.97, 280.96, 280.92, 280.91, 280.90, 280.87, 280.86, 280.85, 280.82, 280.81, 280.78, 280.77, 280.76, 280.72, 280.71, 280.67, 280.66, 280.66, 280.65, 280.62, 280.61, 280.57, 280.56, 280.55, 280.52, 280.51, 280.47, 280.46, 280.45, 280.42, 280.41, 280.40, 280.37, 280.36, 280.32, 280.31, 280.30, 280.27, 280.26, 280.25, 280.22, 280.21, 280.20, 280.17, 280.16, 280.15, 280.12, 280.11, 280.10, 280.07, 280.06, 280.05, 280.02, 280.01, 280.0, 279.97, 279.96, 279.95, 279.92, 279.91, 279.90, 279.87, 279.86, 279.85, 279.82, 279.81, 279.80, 279.77, 279.76, 279.75, 279.72, 279.71, 279.70, 279.67

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee posted marginal gain against the US dollar, appreciating 0.01% in the inter-bank market on Tuesday.

At close, the local currency settled at 279.67, a gain of Re0.03 against the greenback.

On Monday, the local unit closed at 279.70, according to the State Bank of Pakistan (SBP).

The inflow of overseas workers’ remittances into Pakistan stood at $3.46 billion in January 2026, the SBP data showed on Tuesday.

Remittances increased by nearly 15.4% year-on-year (YoY), compared to $3.0 billion recorded in the same month last year. Monthly remittances were down 4% from $3.59 billion in December.

Moreover, the US dollar was weaker on Tuesday before the release of a slate of economic data that is expected to shape the path ahead for interest rates, while the yen firmed for the second day in the wake of Prime Minister Sanae Takaichi’s election victory.

The Japanese yen strengthened to 155.24 per U.S. dollar after rising 0.8% on Monday. Verbal warnings from authorities helped strengthen the yen after the currency weakened in the immediate aftermath of the victory.

The euro stood at $1.19125 after a 0.85% jump on Monday. The dollar index, which measures the greenback against six other currencies, was at 96.79, hovering near a one-week low.

Oil prices, a key indicator of currency parity, were little changed on Tuesday as the market waited for direction from news on Iran and Russia and data on the US economy and US oil inventories.

Brent futures rose 27 cents, or 0.4%, to $69.31 a barrel at 9:58am. EST (1458 GMT), while US West Texas Intermediate (WTI) crude rose 12 cents, or 0.2%, to $64.48.

“The market is still focused on the tensions between Iran and the US,” said Tamas Varga, oil analyst at brokerage PVM. “But unless there are concrete signs of supply disruptions, prices will likely start going lower.”

Inter-bank market rates for dollar on Tuesday

BID Rs 279.67

OFFER Rs 279.87

Open-market movement

In the open market, the PKR lost 2 paise for buying but gained 4 paise for selling against USD, closing at 280.19 and 280.71, respectively.

Against Euro, the PKR lost 1.82 rupee for buying and 1.87 rupee for selling, closing at 333.30 and 336.23, respectively.

Against UAE Dirham, the PKR gained 2 paise for buying and for selling, closing at 76.53 and 77.27, respectively.

Against Saudi Riyal, the PKR gained 2 paise for buying and 1 paisa for selling, closing at 74.81 and 75.38, respectively.

Open-market rates for dollar on Monday

BID Rs 280.19

OFFER Rs 280.71

American Dollar Exchange Rate

American Dollar Exchange Rate