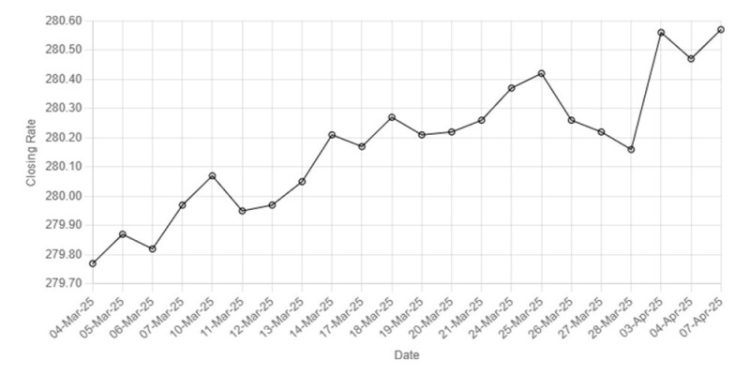

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee saw marginal decline against the US dollar, depreciating 0.04% in the inter-bank market on Monday.

At close, the currency settled at 280.57, a loss of Re0.1 against the greenback.

During the previous week, rupee depreciated against the US dollar as it lost Re0.31 or 0.11% in the inter-bank market.

The local unit closed at 280.47, against 280.16 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

It was a shorter week for currency trading due to Eid-ul-Fitr holidays. The market remained closed from Monday to Wednesday and traded for only the last two days of the week.

Internationally, investors poured into safe havens like the yen and Swiss franc on Monday and heavily sold the risk-sensitive Australian dollar as the market rout from US President Donald Trump’s sweeping tariffs deepened and fears of a global recession grew.

Asian stock markets and Wall Street futures dove and investors wagered that the mounting risk of recession could see US interest rates cut as early as May.

The US dollar was down 0.45% against the yen at 146.21 but had pared some losses after falling more than 1% against the Japanese currency earlier in the session.

The Swiss franc jumped more than 0.6% to 0.8548 per US dollar, extending its 2.3% surge against the greenback last week.

Both currencies have emerged as significant winners in the aftermath of Trump’s latest tariff salvo but others have not.

Trump’s tariff announcements wiped out nearly $6 trillion in value from U.S. stocks last week. When asked about the impact, Trump on Sunday said that sometimes medicine was needed to fix things, adding that he was not intentionally engineering a market sell-off.

More than 50 nations have reached out to the White House to begin trade talks. China, which has struck back with a slew of countermeasures including extra levies of 34% on all U.S. goods, said on Saturday “the market has spoken”.

Assets like government bonds and gold have also risen on safety bids.

While the dollar is also typically known to be a safe haven asset that status seems to be eroding as uncertainty over tariffs and concern over their impact on US growth intensify.

Against a basket of currencies, the US dollar was little changed at 102.81, having tumbled 1% last week.

Oil prices, a key indicator of currency parity, extended losses on Monday, falling 3% as escalating trade tensions between the United States and China stoked fears of a recession that would reduce demand for crude while OPEC+ readies a supply increase.

The Brent and WTI benchmarks both dropped to their lowest since April 2021.

Brent futures lost $1.94, or 3%, to $63.64 a barrel by 1130 GMT and US West Texas Intermediate crude futures were down $1.94, or 3.1%, at $60.05.

Oil plunged by 7% on Friday as China ramped up tariffs on US goods, escalating a trade war that has led investors to price in a higher probability of recession.

Last week Brent and WTI lost 10.9% and 10.6%, respectively.

American Dollar Exchange Rate

American Dollar Exchange Rate